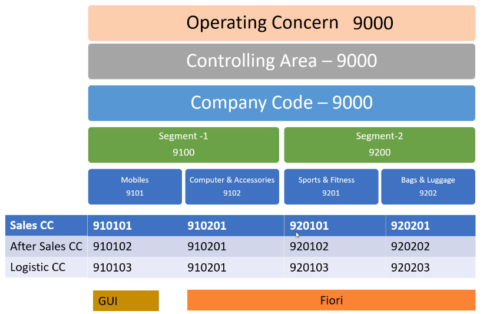

Top node is Operating Concern. This is defined for tracing profitability report and internal management.

Under Operating Concern there is Controlling Area. Controlling Area is also part of CO module.

Under Controlling Area, there will be Company Code, which is the legal entity. This is responsible for generating income reports for external reporting. Company Code is part of FI module.

Under Company Code, there will be Segments and under that profit centers based on products and services provided by the company.

Under the profit center there will be cost centers, that are departments, that handle various functions like sales, logistics etc. Cost Center is part of CO module.

Company Code, Segments and Plants are part of FI module, we can get financial legal segment at these levels.

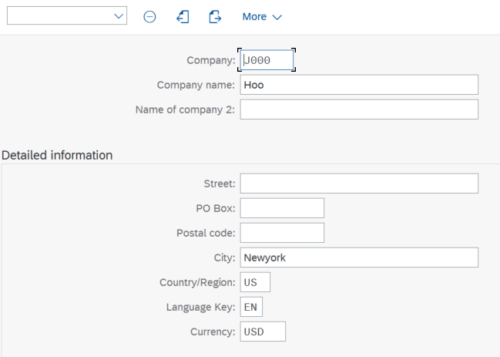

Define Company

TCode: OX15

Path:

IMG–>Enterprise Structure–>Definition–>Financial Accounting–>Define company

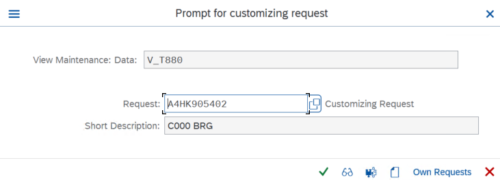

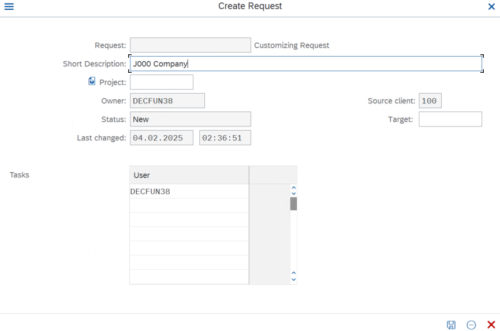

Customization Request

Any changes we do in the environment will be saved as a customization request so that we can move these changes across client for testing production etc.

All related changes will be saved under same customization request.

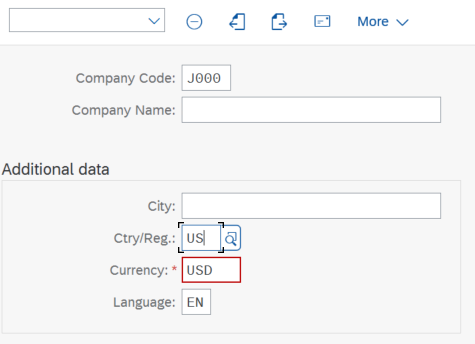

Define Company Code

TC – OX02

IMG–>Enterprise Structure–>Definition–>Financial Accounting–>Edit, Copy, Delete,

Check Company Code

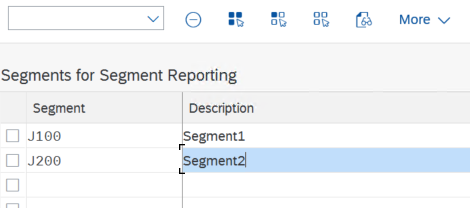

Define Segment

Path:

IMG–>Enterprise Structure–>Definition–>Financial Accounting–>Define Segment

Assign Company Code To Company

TC- OX16

Path:

IMG–>Enterprise Structure–>Assignment–>Financial Accounting–>Assign company

code to company

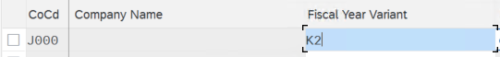

Define Fiscal Year Variant

TC – OB29

Here we will not be defining anything new. We will be using K2

Assign Company Code To Fiscal Year Variant

TC – OB37

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers–>Fiscal

Year and Posting Periods–>Assign Company Code to a Fiscal Year Variant

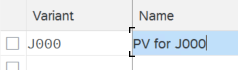

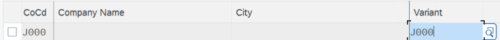

Define Variants for Open Posting Periods

TC- OBBO

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers–>Fiscal

Year and Posting Periods–>Posting Periods–>Define Variants for Open Posting Periods

This is configuration activity done by consultant.

In companies month is considered as period. Some companies will finalize trial balance after a period is over, so this period needs to be locked.

Except for current month all months will be locked. This is decided by Posting Period Variant.

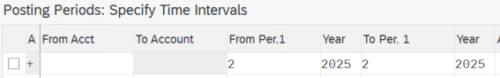

Account Types

There are account types in SAP. The account types were already defined in the system. They cannot be edited or we cannot create new. The following are the account types defined in the system.

- S : G/L Accounts

- K: Vendor

- D: Customer

- A: Assets

- M: Material

- +: All Types

We can lock posting period at account type level as well.

Assign Posting Period Variant To Company Code

TC- OBBP

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers–>Fiscal

Year and Posting Periods–>Posting Periods–>Assign Variants to Company Code

We can assign same Posting Period Variant to any company code.

Open and Close Posting Periods

TC- OB52

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers–>Fiscal

Year and Posting Periods–>Posting Periods–>Open and Close Posting Periods

Here we opened posting period for current month for all accounts.

Transaction Code for End-users: S_ALR_87003642

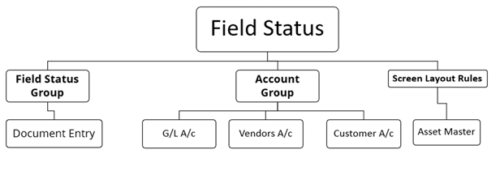

We input any data into system through fields. Fields will be present in any form that we use to create document for posting.

A field can have 3 status:

- Supressed

- Required

- Optional

Here we are defining how a fields in a form should behave.

Filed status can be defined for transaction level field groups or for creating master data fields.

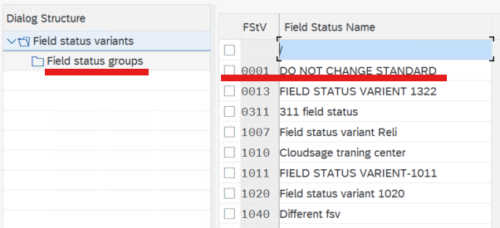

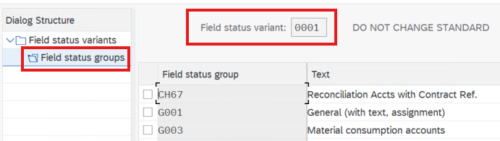

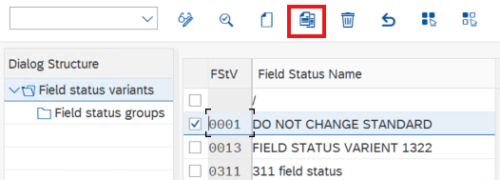

Define Field Status Variants

TC- OBC4

Here we will see all the defined filed status variants. For each variant we can se the field status groups defined within.

Here we don’t have to create a new variant, we can copy existing one and give our name.

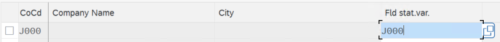

Assign Company Code to Field Status Variants

TC – OBC5

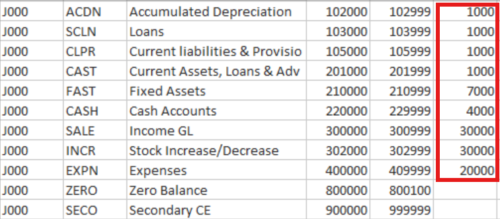

3 types of Chart Of Accounts are available in SAP

- Operational T-Code : OB62

- Group T-Code : OB13

- Country Specific T-Code : OB62

Only operational is mandatory.

Group and country chart of accounts are only needed if there is requirement for a legal financial report of group of companies.

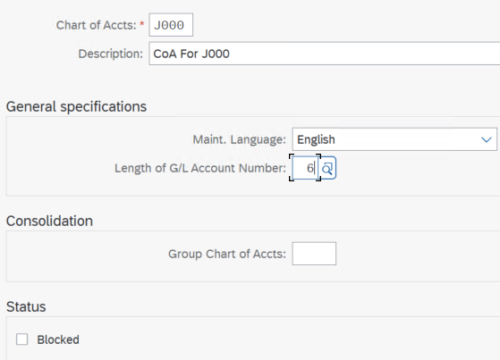

Define Chart of Accounts

TC – OB13

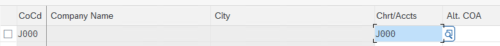

Assign Company Code To Chart Of Accounts

TC- OB62

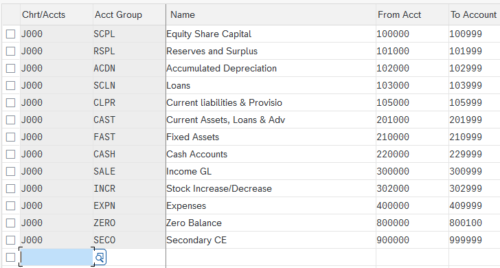

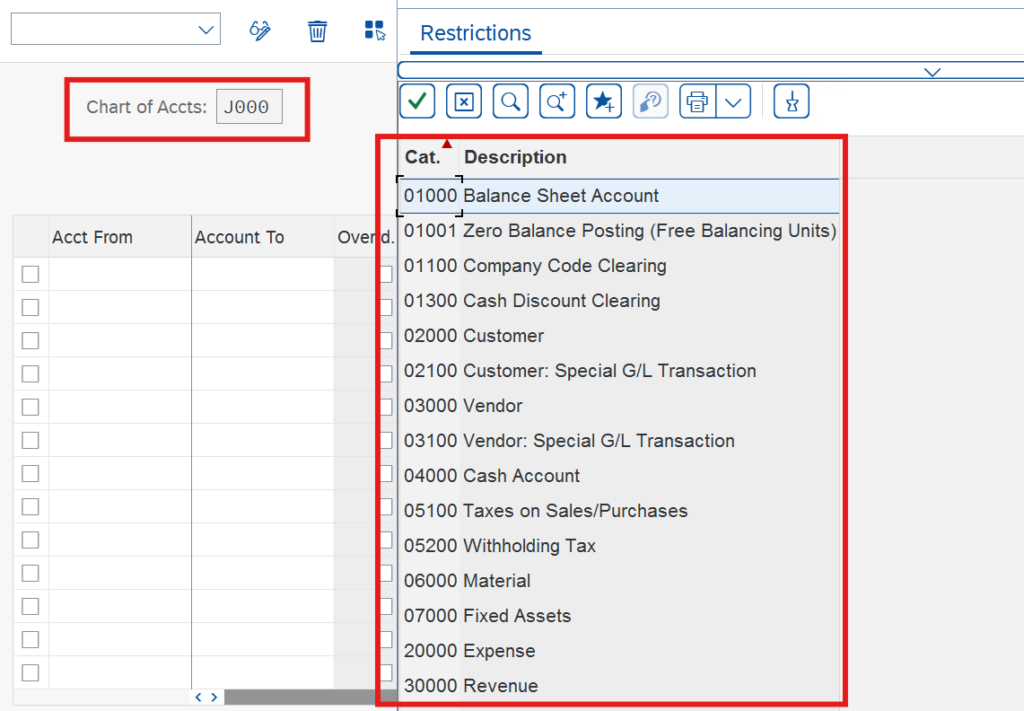

Define Account Groups

TC- OBD4

Under a Chart of Account there can be many Account Groups.

Each group will have its own code and name for identification. Individual accounts under each group takes a unique number, which is defined by number ranges.

| CoA | Acc Gp | Gp Name | Acc From | Acc To |

| J000 | SCPL | Equity Share Capital | 100000 | 100999 |

| J000 | RSPL | Reserves and Surplus | 101000 | 101999 |

| J000 | ACDN | Accumulated Depreciation | 102000 | 102999 |

| J000 | SCLN | Loans | 103000 | 103999 |

| J000 | CLPR | Current liabilities & Provisio | 105000 | 105999 |

| J000 | CAST | Current Assets, Loans & Adv | 201000 | 201999 |

| J000 | FAST | Fixed Assets | 210000 | 210999 |

| J000 | CASH | Cash Accounts | 220000 | 229999 |

| J000 | SALE | Income GL | 300000 | 300999 |

| J000 | INCR | Stock Increase/Decrease | 302000 | 302999 |

| J000 | EXPN | Expenses | 400000 | 409999 |

| J000 | ZERO | Zero Balance | 800000 | 800100 |

| J000 | SECO | Secondary CE | 900000 | 999999 |

Starting digit will determine the type account. More than 1 groups can be of same type:

- 1 – Liabilities

- 2 – Assets

- 3 – Income

- 4 – Expenses

- 8 – Zero Balance

- 9 – Secondary Cost Elements

These account types can be selected in T-Code FS00, when we create G/L accounts

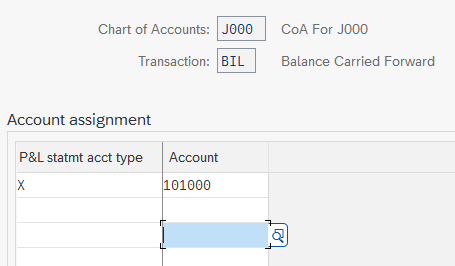

Define Retained Earnings Account

TC- OB53

This is account to carry-over profit or loss from previous year.

For this we will using one account under Reserves and Surplus account group.

Note: Here we are only assigning the account number, we have not created the account yet. So we will get a warning. Ignore warning and press enter to proceed.

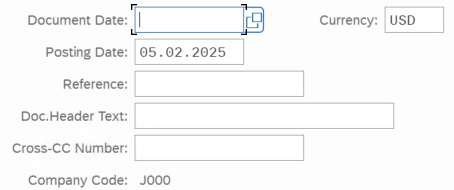

The document type is a key that is used to classify Accounting documents and distinguish

between business transactions to be posted.

We can find these in T-Code: OBA7

We have to define number ranges for these document type.

Here will be doing that for SA document which is for G/L accounts. That is if we want to past any payment to any G/L accounts in the Chart Of Accounts we defined, we create a SA document.

SA documents have number range 1-99999; This is different from Number ranges of account groups in chart of accounts.

Other document types like RE, RV, these will be configured during MM and SD configuration.

When something get posted we can know from the number of document, that amount is related to G/L or any other sources like non-G/L accounts.

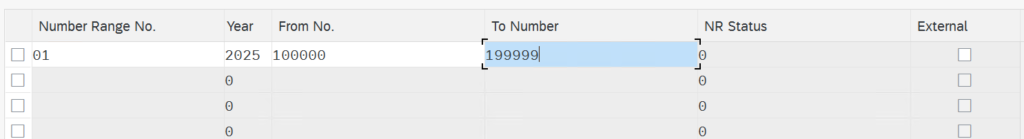

Define Number Ranges For Document Type “SA”

TC – OBA7

Select SA and provide the Company code.

If we check that box for external number range, we have to manually put the document number.

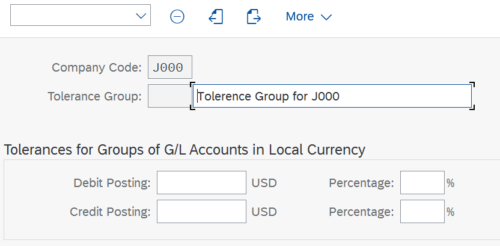

Define Tolerance Groups For G/L Accounts

TC – OBA0

We can leave the group name blank, blank is also a group in SAP.

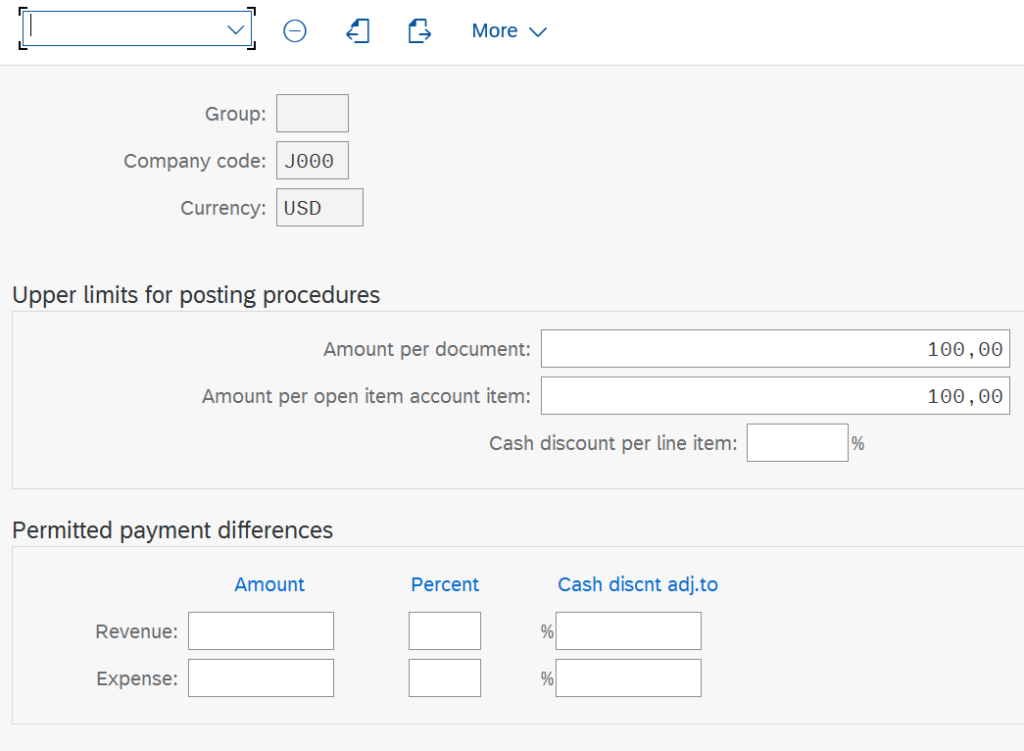

Define Tolerance Groups For Employees (End-User)

TC – OBA4

Assign Users to Tolerance Groups

TC- OB57

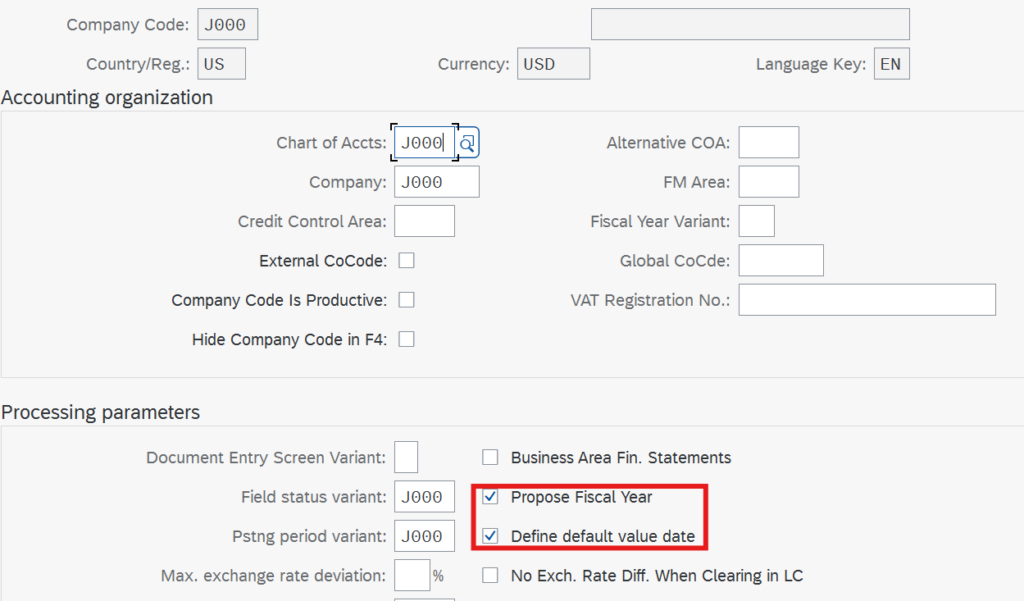

Enter Global Parameters

TC – OBY6

Select “Propose fiscal year”

Select “Define default value date

Assign Country to Calculation Procedure

TC – OBBG

We are assigning “TAXUS” for temporary basis, we will change this during Tax on

Sales/Purchase Configuration.

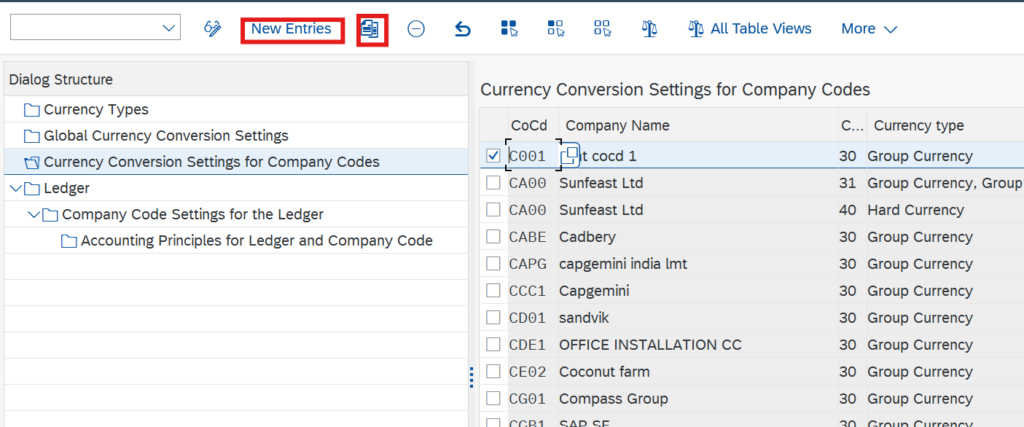

In S/4 HANA , We can have 10 currencies for reporting purpose. It’s a major change.

A company code can have currency but it can also have reports in other currencies as well.

Currency number 10 is currency defined at company code level.

Currency number 30 is currency defined at client level. Client level is the top most level in SAP and currency defined at this level is called Group Currency.

Group Currency

Check Group Currency at TC-SCC4

Group currency is also called client level currency, because it is defined at client level.

Group currency is has number 30 in SAP.

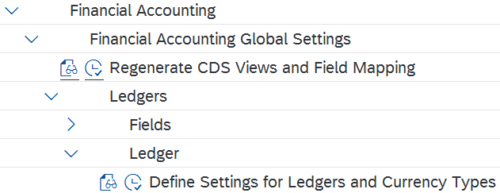

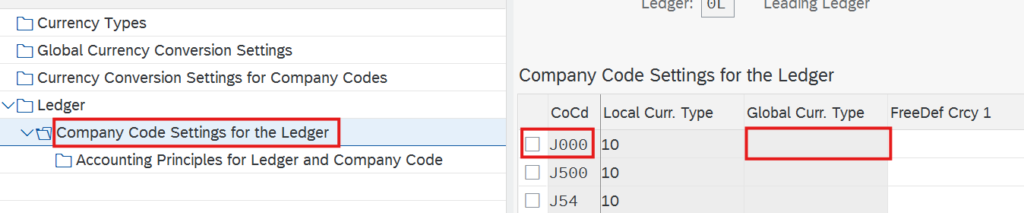

Define Settings for Ledgers and Currency Types

T-Code: FINSC_LEDGER

Path:

IMG–> Financial Accounting –> Financial Accounting Global Settings –> Ledgers –>

Ledger- – > Define Settings for Ledgers and Currency Types

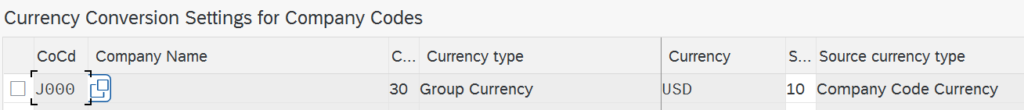

Here add new entry or copy an existing for Currency Conversion settings for company code.

While copying change company code to your company code.

exchange rates are maintained at T-Code: OB08

Global currency will be populated when we do controlling configuration

If Group and company currency are same we don’t need to maintain exchange rate in Currency Conversion settings for company code

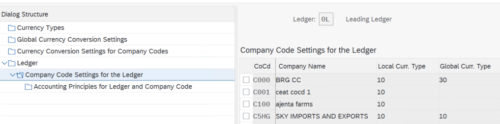

Once settings is done we can see it in Company Code settings for Ledger tab

Global Currency Type will be populated later when we configure controlling area.

Fiscal year and posting period variants should be automatically copied.

Month-end activities are automated using the document splitting.

There are 2 approaches classical profit center accounting and new G/L.

If we are using new G/L we have to activate document splitting.

Document splitting will help to prepare our financials at segment level and profit center level.

For legal purpose we need reports at 3 level, company, segment and profit center level.

As per new SAP system, when we post a document, system will generate additional document for profit center.

To check this go to FB03, and see the list of posted documents.

Select a document and go to Environment > Document Environment > Accounting Document

For New G/L:

This will show 2 documents : Accounting document and a controlling document.

For Classical Profit center accounting

it will show 1 more document called profit center document.

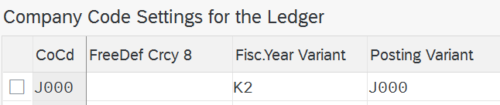

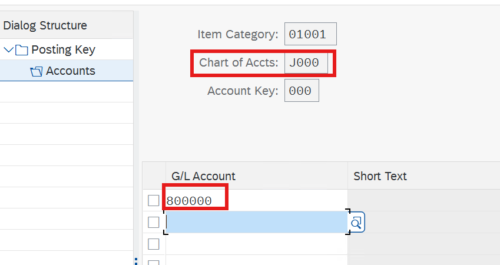

Classify G/L Accounts for Document Splitting

Path:

IMG–>Financial Accounting–>General Ledger Accounting–>Business Transactions-

Document Splitting–>Classify G/L Accounts for Document Splitting

Select our Chart of Accounts, and add new entries:

From the categories selection filed we will be able to view all the available categories in the SAP.

Based on the available category, we are categorizing the account groups we defined in Chart Of Accounts

Classify Document Types For Document Splitting

Here SAP as already defined some document types for document splitting.

We don’t have to make any changes here.

Define Zero-Balance Clearing Account

IMG–>Financial Accounting–>General Ledger Accounting–>Business Transactions-

Document Splitting–>Define Zero-Balance Clearing Account

Here we are setting 1 account from our Chart of Accounts, account groups for zero balance as zero-balance clearing account.

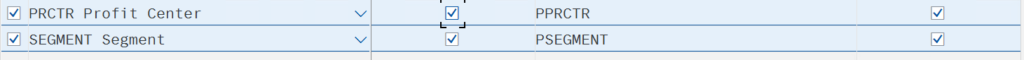

Define Document Splitting Characteristics for General Ledger Accounting

IMG–>Financial Accounting–>General Ledger Accounting–>Business Transactions-

Document Splitting–>Define Document Splitting Characteristics for General Ledger

Accounting

We need financial statement at profit center level and segment level, so we make these mandatory. We need to check zero balance capability for segment and profit center.

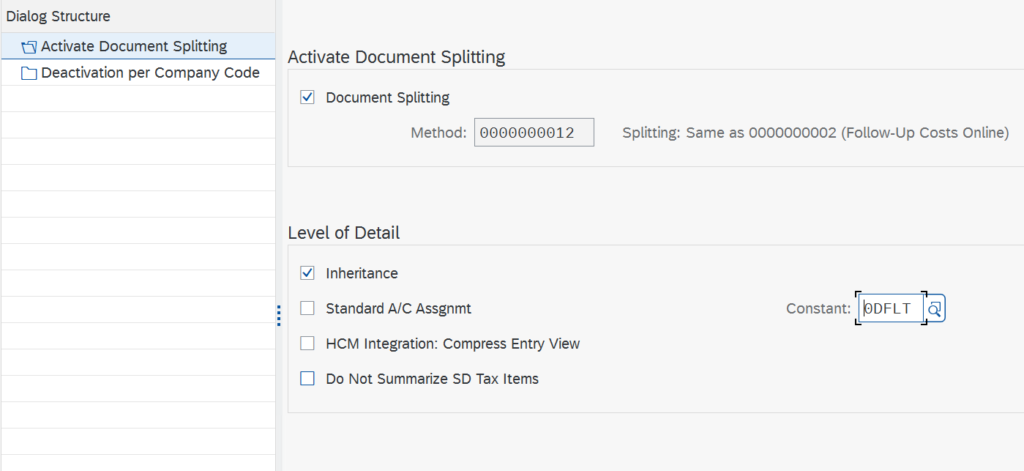

Activate Document Splitting

IMG–>Financial Accounting–>General Ledger Accounting–>Business Transactions-

Document Splitting–>Activate Document Splitting

Select “Document Splitting “check box

Select “inheritance” check box

If we want to deactivate document splitting for a company code, we can do that from the other tab.

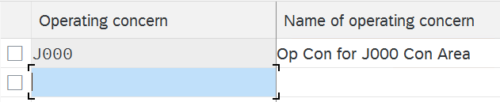

Here we have to create 2 objects

- Controlling Area

- Operating Concern

Operating concern is not mandatory if you don’t have COPA implementation in your project.

OC and CA are the top nodes in the organizational structure.

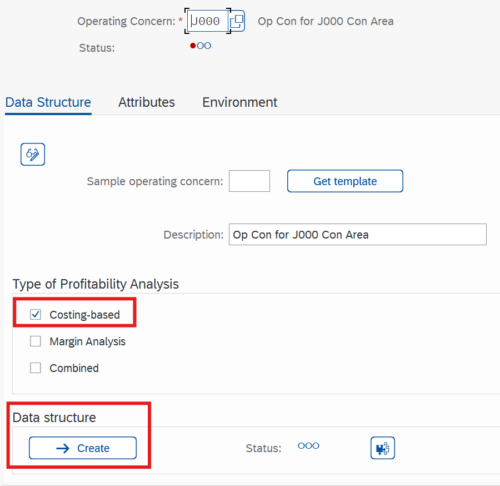

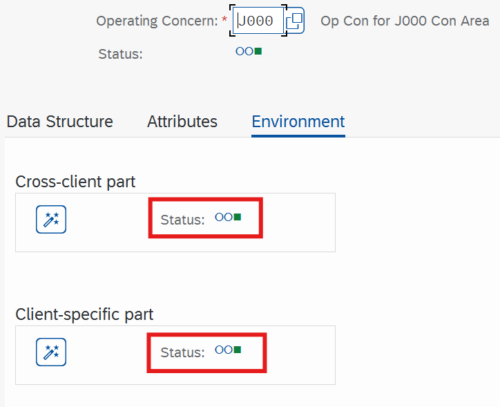

Create Operating Concern

IMG–>Enterprise Structure–>Definition–>Controlling–>Create Operating Concern

Click on New Entries

Maintain Operating Concern

Before activation of operating concern we need to do these steps.

IMG–>Controlling–>Profitability Analysis–>Structures–>Define Operating Concern-

Maintain Operating Concern

Select Costing Based check box

Click on Create Button

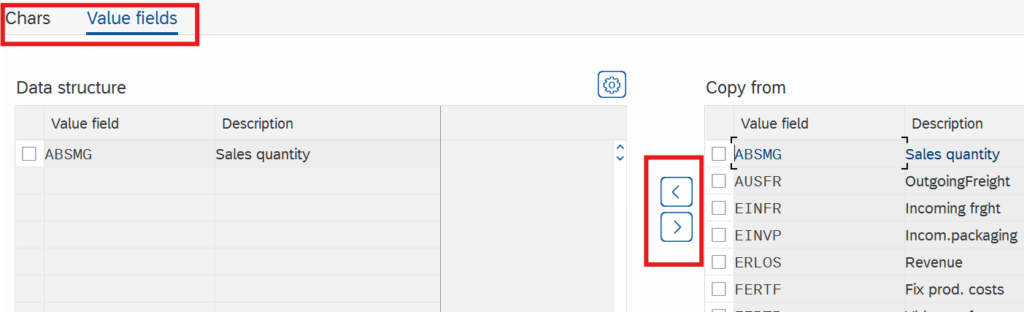

Select any Characteristics

Select any Value Field

Click on Activate

Click on back Button

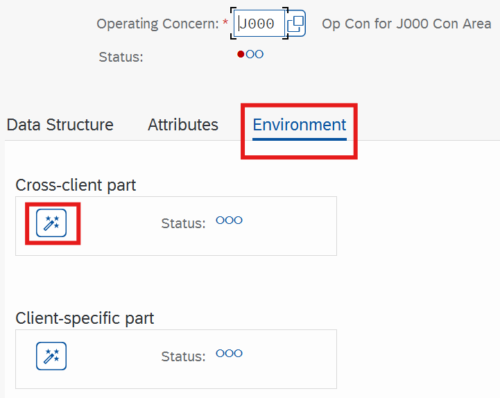

Click on Environment Tab

Activate Cross-client

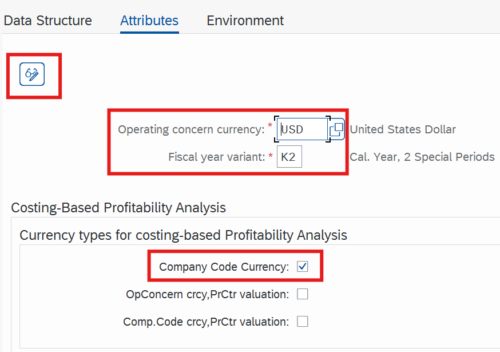

Click on Attributes Tab

Click on change icon

Operating concern currency

Fiscal year variant

Select “Company Code Currency check box ‘>> Save

Do you want to generate the client-specific part? >> Yes

Once it is done in the environment tab we will see it as active.

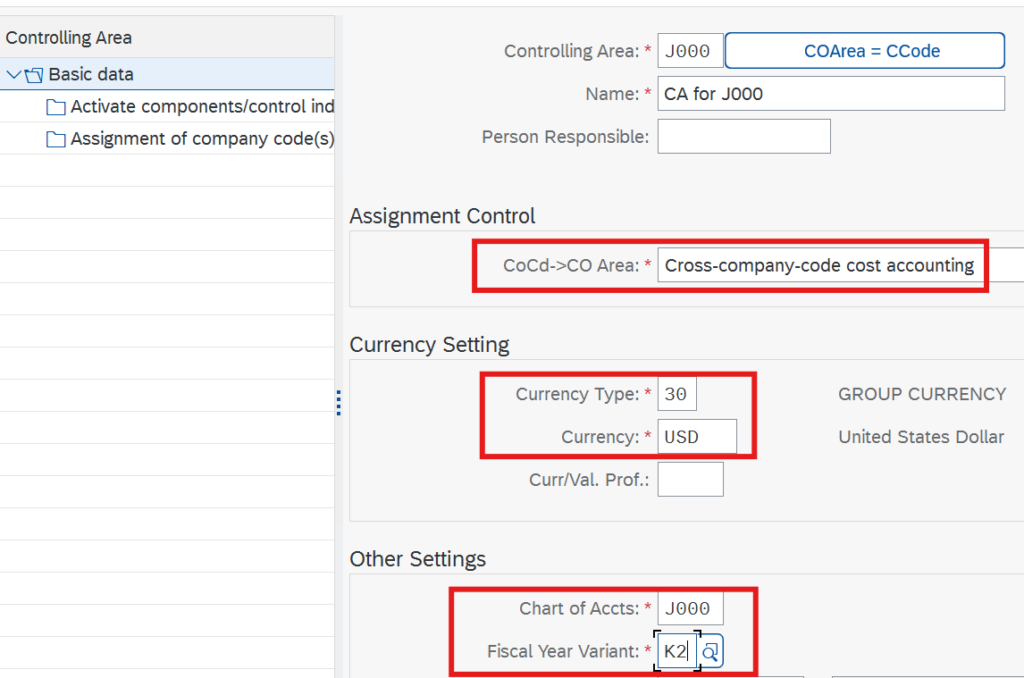

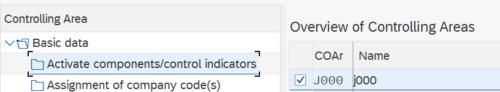

Maintain Controlling Area Path

TC – OKKP

We need controlling area for management reporting.

Also define Cost Center Standard Hierarchy as : CC_STD_HIE

In Company Code to Controlling Area we select cross company, so that we can add more companies under same controlling area.

Assign controlling area to operating concern

IMG–>Enterprise Structure–>Assignment–>Controlling–>Assign controlling area to

operating concern

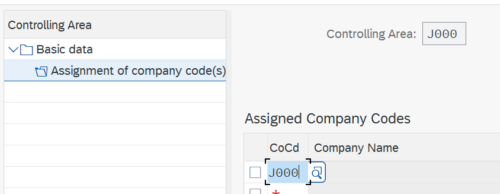

Assign company code to controlling area

OKKP

IMG–>Enterprise Structure–>Assignment–>Controlling–>Assign company code to

controlling area

New Entry:

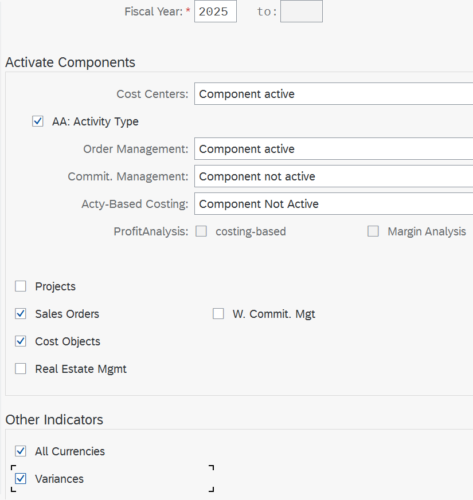

Maintain Controlling Area- Components

IMG–>Controlling–>General Controlling–>Organization–>Maintain Controlling Area

Make following selections:

Double Click “Activate Components / Control Indicators”

Click on New Entries Fiscal Year

= Component active

Select “AA: Activity type” (AA: Account Assignment)

Order Management

= Component active

Select Sales Order / Cost Object check box

Select All currencies

Select variances

Click on Save

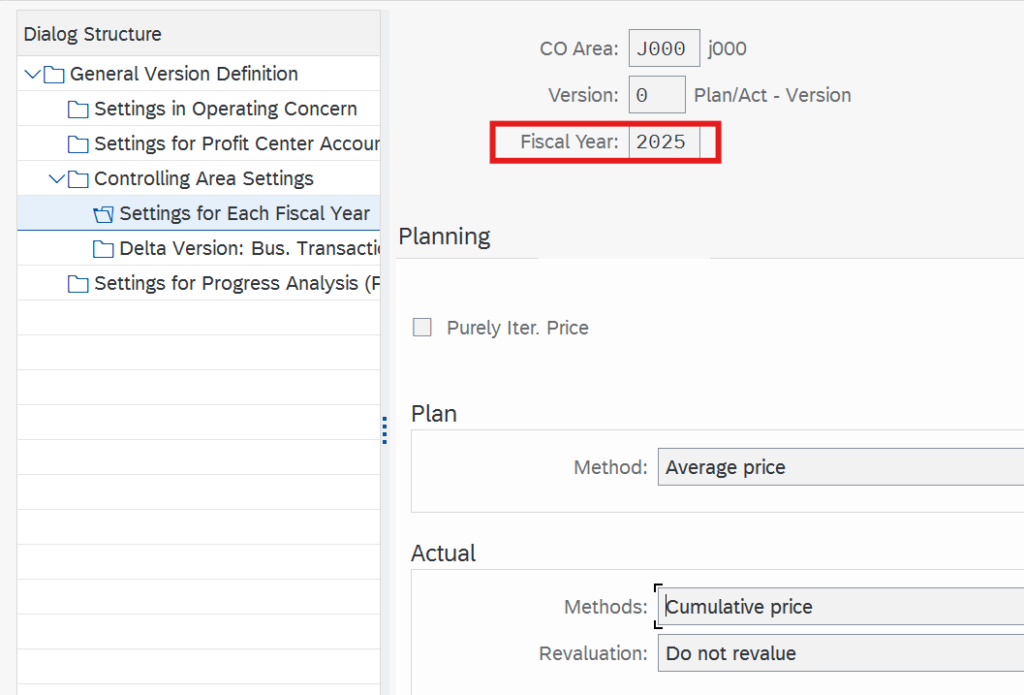

Maintain versions

TC – OKEQ

IMG–>Controlling–>General Controlling–>Organization–>Maintain Versions

Select Version “O” line.

Double Click “Settings for each Fiscal Year”

Here we can modify settings for FY Planning

Imagine you have a big toy store. You sell many toys, and people come to buy them. Every time someone buys a toy, you write it down in two special notebooks:

- Money Notebook (FI – Financial Accounting) – This notebook keeps track of how much money you received and spent.

- Toy Notebook (CO – Controlling) – This one keeps track of which toys are selling well and how much each toy costs to buy and sell.

Now, when you sell a toy, you need to write in both notebooks so everything is correct. SAP helps to make sure that when you write in one notebook (FI), the same information also goes to the second notebook (CO). This is what we are doing here: connecting the two notebooks!

How FI and CO Work Together

In SAP S/4HANA, Financial Accounting (FI) is used for legal financial reporting, while Controlling (CO) helps track costs and profits within the company.

FI (legal accounting) and CO (internal management accounting)

When we post financial transactions (like rent payments, vendor invoices, or customer payments), these transactions must also be recorded in Controlling (CO). This process ensures that CO has accurate cost and revenue data.

Here’s what we are doing in this process:

- Define Document Types for Postings in Controlling

- Just like FI has document types for different transactions (e.g., SA for General Ledger posting), CO needs its own document types.

- These document types help SAP differentiate between different kinds of postings.

- Define Document Type Mapping Variants for CO Business Transactions

- Each transaction in FI (like paying rent or receiving money) is a “business transaction.”

- We map these transactions to the correct CO document type, so FI and CO remain in sync.

- Check and Define Default Values for Postings in Controlling

- We assign the correct company code to the system so that FI data is transferred correctly to CO.

- This step ensures that SAP knows where to send FI transactions inside CO.

- Define Ledger for CO Version

- In FI, we have a ledger where all financial postings are stored. The standard ledger in SAP is 0L (Leading Ledger).

- In CO, we have a version that stores controlling-related data. The standard version in CO is 000 (Actual Version).

- Here, we connect the FI ledger (0L) with the CO version (000), ensuring CO can read FI data correctly.

This integration allows smooth data flow between FI and CO, ensuring cost tracking and financial reports are accurate.

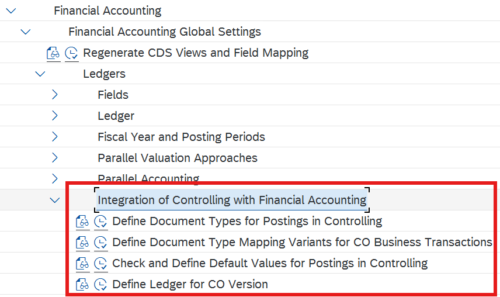

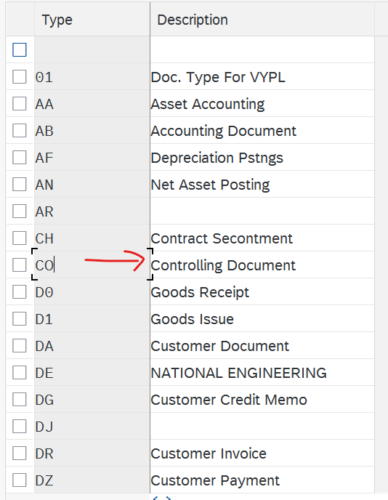

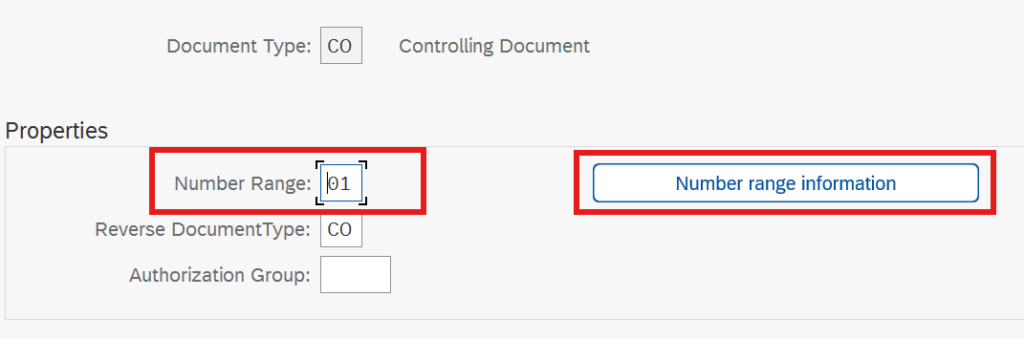

Define Document Types for Postings in Controlling

T-code : OBYA

Path:

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers-

Integration of Controlling with Financial Accounting–>Define Document Types for

Postings in Controlling

Here we will see a list of document types used in SAP system. These document types are used for both FI and CO modules. For example CO document type is used for posting into CO module and SA document type is used to post to FI module.

When we double click on each document type we will see the number range information for that document type.

When we click the number ranges button next to it, we will be able to see the number ranges defined for our company.

If a company has a number range number of 01 and if CO and SA document types has number range value of 01, if we post a document of type CO or SA it will be assigned an automatic number within the ranges defined between ‘From Number’ and ‘To Number’.

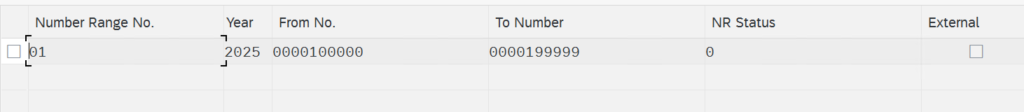

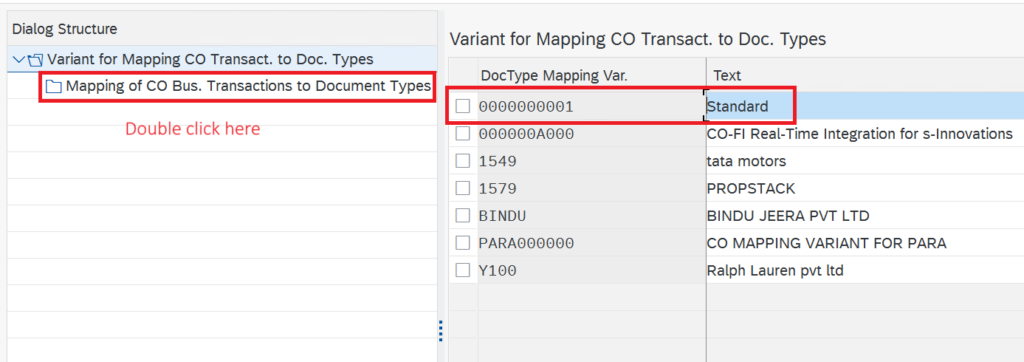

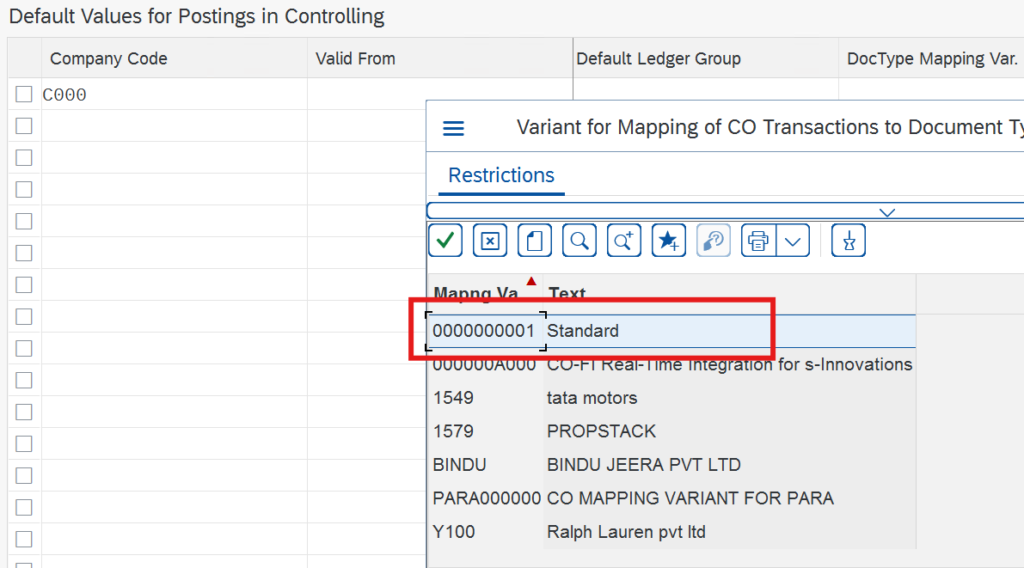

Define Document Type Mapping Variants for CO Business Transactions

When we post any document to FI, like when we post a document paying rent, or receiving money, it will create a business transaction. We need to map these to correct CO document type.

Path:

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers-

Integration of Controlling with Financial Accounting–>Define Document Type Mapping

Variants for CO Business Transactions

Here we will be able to see some mapping variant provided by SAP. We can also see the mapping if we double click.

Posting of any FI document is a business transaction like Posting Vendor invoice, Customer invoice etc. We cannot directly post a CO document type.

We have to map business transaction to a CO document type. Which is done here

If you want to change mapping you have to copy the default variant given by SAP. Don’t edit on default mapping variant.

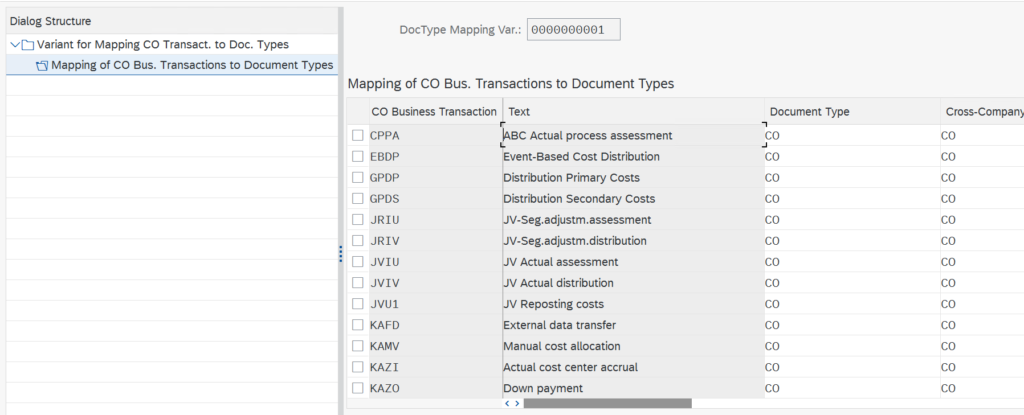

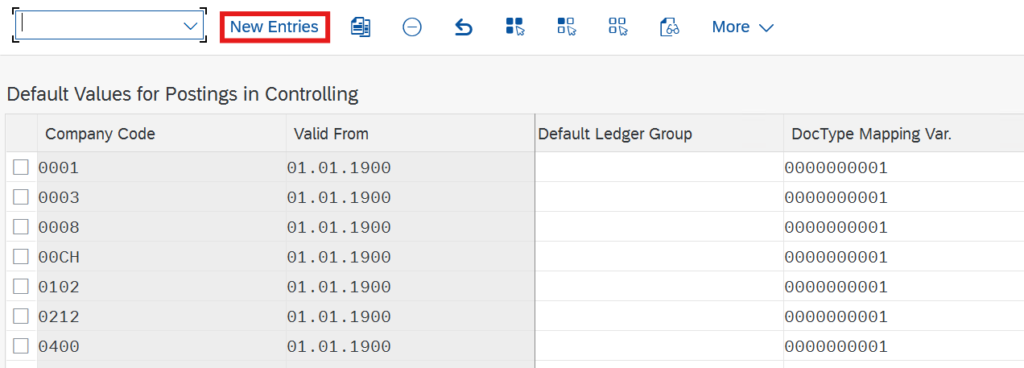

Check and Define Default Values for Postings in Controlling

Path:

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers-

Integration of Controlling with Financial Accounting–>Check and Define Default Values

for Postings in Controlling

Here we will be defining which CO mapping variant should be used by a company code by default.

If it is not already done you have to add an entry for your company code.

Select the standard mapping provided by SAP.

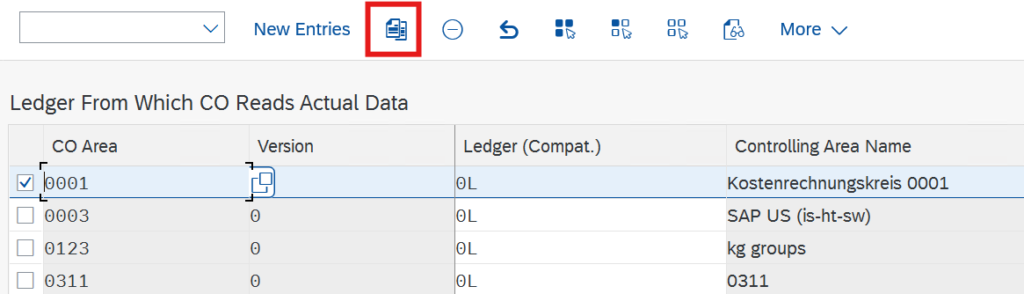

Define Ledger for CO Version

When we post any FI Document type, the amount details will be saved under a default FI ledger called 0L ledger.

Like FI has ledger, CO has version.

So here we are linking 0L to CO version 0.

So here when we post any document in FI like vendor invoice or customer invoice, CO will take data from 0L. Here we are saying:

“Hey CO, when you record costs, make sure they align with this main ledger in FI.”

Path:

IMG–>Financial Accounting–>Financial Accounting Global Settings–>Ledgers-

Integration of Controlling with Financial Accounting–>Define Ledger for CO Version

We can copy an existing definition for our company code.

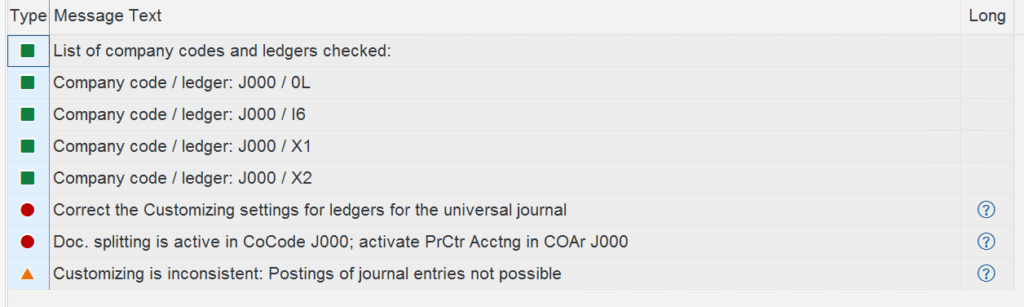

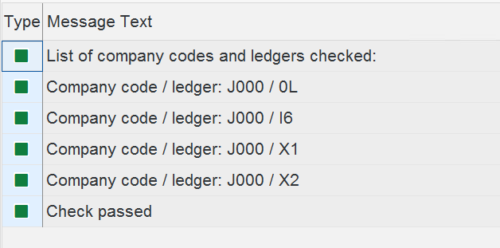

Here we will be checking if there is any issues with the configuration.

T-Code : FINS_CUST_CONS_CHK_P

We can put in the company code here to check for any issues.

We should resolve any issues before proceeding.

We can resolve the error by going into Performance assistance window.

If all issues are resolved we get all green marks

Common errors

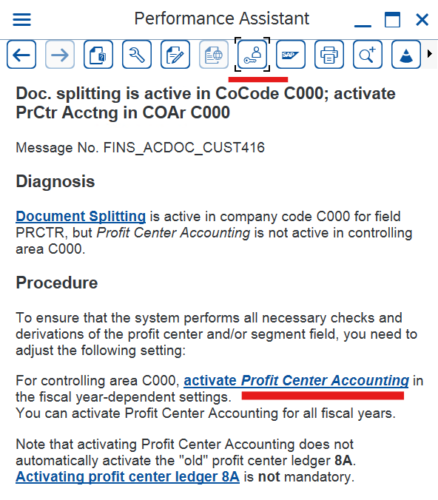

Doc. splitting is active in CoCode xxx; activate PrCtr Acctng in COAr xxx

Continue without specifying project

Set Controlling Area

OKKS

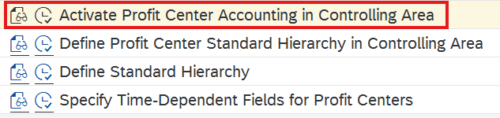

Activate Profit Center Accounting in Controlling Area

IMG–>Financial Accounting–>General Ledger Accounting–>Master Data–>Profit

Center–>Activate Profit Center Accounting in Controlling Area

Select active check box for your company code

This step is already done to resolve consistency check.

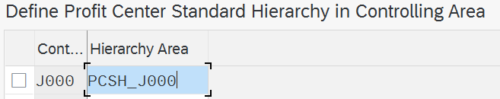

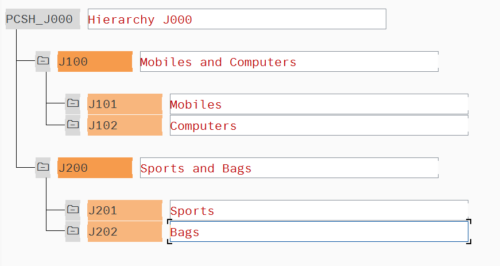

Define Profit Center Standard Hierarchy in Controlling Area

IMG–>Financial Accounting–>General Ledger Accounting–>Master Data–>Profit

Center–>Define Profit Center Standard Hierarchy in Controlling Area

This is required while creating profit centers.

Define Standard Hierarchy

IMG–>Financial Accounting–>General Ledger Accounting–>Master Data–>Profit

Center–>Define Standard Hierarchy

Resolving Consistency Check Issues

FINS_CUST_CONS_CHK_P